how to get ifta stickers in pa

Georgia IFTA decal renewals and licenses are issued and valid for one year from January 1st through December 31st. Complete the IFTA Licensing Application Form RDT-120.

Motor Carrier Road Tax MCRT statutes andor the International Fuel Tax Agreement.

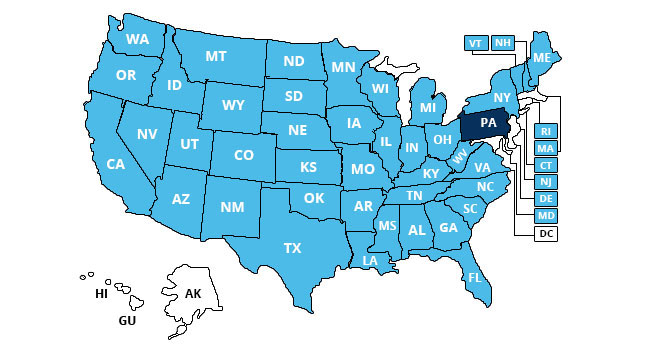

. IFTA refers to the International Fuel Tax Agreement of the US government. PA IFTA quarterly payments are determined by the total amount of miles travelled and gallons purchased in each state. You need to display one on each side of your truck cab. Applicant further agrees that Pennsylvania may withhold any.

The carrier only pays the net tax due to all jurisdictions. File Form IFTA-21 New York State International Fuel Tax Agreement IFTA Application. IFTA Stickers expire on December 31st of each year. IFTA-300 -- Individual Vehicle Mileage Records.

PA DEPARTMENT OF REVENUE. When the license is renewed youll also receive two IFTA stickers and IFTA decal that must be displayed on each side of the vehicles cab. Therefore you may place any set of decals you are issued on any qualified vehicle in your fleet. No IFTA Sticker Fine Amounts.

IFTA-200W -- IFTA Decal Waiver. All 2014 IFTA and PA MCRT decals will be the same color and formatting as the samples above. Your Pennsylvania IFTA license is valid for the calendar year January 1 through December 31. Yes the state of Pennsylvania still requires you to submit a zero report even if no fuel or IFTA mileage was traveled in that quarter.

Do I file a quarterly fuel tax report if I didnt run during the quarter. 31 of each year. How many decals do you need. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

There is no fee for the license which is valid. An IFTA license which should be photocopied and carried in each of your qualified vehicles. For example the State of Illinois has a minimum 1000 penalty for failure to display. IFTA-200S -- Application for Additional Motor Carrier Road TaxIFTA Decals.

Online videos and Live Webinars are available in lieu of in-person classes. Furthermore if you operate in two or more member provinces or states you can register for IFTA and take advantage of everything it has to offer. How to request DOT pin number. Add IFTA and PA MCRT decals requested.

Businesses impacted by the pandemic please visit our COVID-19 page Versión en. You have until March 1 of each year before you must carry a current IFTA license. After we approve your application we will issue one IFTA license for your fleet of vehicles. Although IFTA fuel tax calculation and reporting can be overwhelming you can use the KeepTruckin fleet management solution to simplify the process.

You are required to keep a daily mileage log that identifies routes travelled miles travelled in each state and gallons purchased in each state. This video will break down exactly how easy it is to file your quarterly IFTA report online. Such decals will be honored in lieu of PA IFTA or PA MCRT decals. Number of vehicles that travel in PA exclusively Total Decals requested.

IFTA is an agreement among taxing jurisdictions that simplifies. To get back to the taxes. Include 10 for each set of IFTA decals requested. PA Department of Revenue.

Any carrier operating in Pennsylvania and at least one other jurisdiction must register with a base state pursuant to the International Fuel Tax Agreement IFTA. Using an active IFTA sticker is crucial for the success of any trucking company. Applicant purchasing IFTA decals agrees to comply with tax reporting payment recordkeeping and license display requirements as specified in the. Hence not to forget all IFTA certified vehicles should have two IFTA stickers all the way.

Regardless of how many States the truck driver has driven all fuel taxes will be issues on one fuel tax license. Motor and Alternative Fuel Taxes. IFTA-200A -- Motor Carriers Road TaxIFTA New Account Registration Application. An IFTA license and decals expire on Dec.

Check or money orders payable to PA Department of Revenue. IRP IFTA Apportioned Plates Fuel License 53. Also known as Apportioned Plates and Prorate Account. Get an IFTA Sticker Through Our Organization Today.

The International Fuel Tax Agreement IFTA was imple-mented in Pennsylvania in 1996 to allow motor carriers based in Pennsylvania to file one tax return with their base jurisdiction Pennsylvania on which the taxes due to all jurisdictions would be reported and paid. However fines for failure to display your IFTA decals range between several hundred to a couple thousand dollars. IFTA is designed to make fuel tax licensing and reporting requirements for interstate motor carriers easier. DO NOT send cash.

To purchase your decals complete a Motor Carriers Road TaxIFTA New Account Registration Application IFTA-200A and send it along with your check or money order made payable to PA Department of Revenue to the following address. Please contact the local office nearest you. Multiply total decals requested by 12 IFTA Decals. Only things youll need are your mileage and fuel purchase summa.

IFTA is the fuel tax decals and license for the same vehicles. You are allowed until March 1 of the following year before you must carry a current IFTA license and display current decals on your vehicles. Another two-letter base-state designator will appear in place of PA on decals from other jurisdictions. Most Ifta stickers for the same year are identical.

A set of two identical decals for each of your. Pennsylvania and not exempted by law or regulation must register for Motor Carrier Road Tax MCRT. Having no IFTA sticker displayed can result in a fine amount that varies based on the applicable jurisdiction. Our organization helps businesses renew IFTA stickers and secure new ones.

What is the Expiration Date and Renewal Period for a IFTA Sticker. Complete these two steps. Before your license can be accepted for renewal all taxes must be paid up-to-date. How TruckingOffice Can Help.

Under IFTA you will register with one state or province as your base jurisdiction and get. If New York State is your base jurisdiction follow the steps below to get your initial IFTA license and decals. When you apply for IFTA credentials you will also receive. You will be provided two IFTA decals for each licensed vehicle.

IRP -International Registration Plan is the registration required for vehicles over 26000 pounds that cross state lines. For more details read how you can easily calculate IFTA fuel tax with KeepTruckin. For questions about filing extensions tax relief and more call. Further you can find more details about it.

You can also pay online using IFTA Web File if you prepare tax documents yourself use a computer to prepare filings and have broadband Internet access. IFTA Pennsylvania allows you to file for your ifta sticker renewal electronically. The IFTA license will be similar in appearance to the licenseroad tax.

Form Ta Vp 211 Download Fillable Pdf Or Fill Online Vermont Based International Fuel Tax Agreement Ifta Motor Fuel Tax License Credentials And Decals Vermont Templateroller

Pennsylvania Pa Ifta State Tax Ifta Quarterly Fuel Tax Ifta Online

Ifta 200s Application For Additional Motor Carrier Road Tax Ifta Decals Free Download

Posting Komentar untuk "how to get ifta stickers in pa"